Will apartment prices catch up to houses?

The gap between Australia’s house and unit values has reached an all-time high in January of 28.2 per cent, despite the nation experiencing double-digit growth rates for both houses and units over the past 12 months.

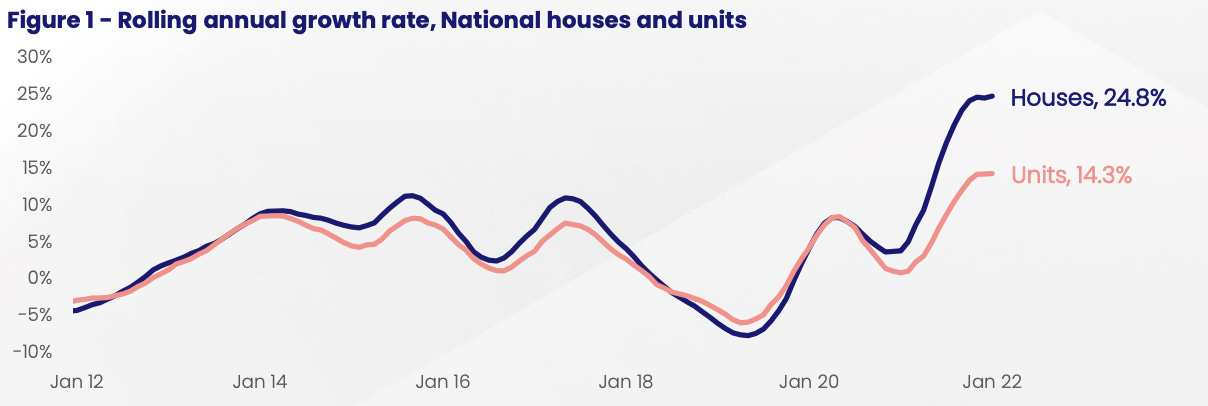

According to the latest monthly Unit Market Update, data shows units recorded an annual growth rate of 14.3 per cent in the 12 months to January 2022, while house values rose 24.8 per cent over the same period. When combined, it’s Australia’s highest annual dwelling growth in over 30 years.

CoreLogic Research Analyst, Kaitlyn Ezzy said, “although house growth has traditionally outpaced unit growth over the past decade, the performance gap throughout the current upswing has been notably higher than in previous cycles, thanks in part to COVID-related demand shocks disproportionately affecting unit demand”.

When looking at the annual performance gap between houses and units, the disparity began to narrow in the final three months of last year, as a result of the lifting of lockdowns and border restrictions as well as increasing affordability constraints pushing demand towards the medium to high-density sector.

Thus far in 2022, in January the annual performance gap started to widen again, which according to CoreLogic could, in part, could be explained by the disparity between the advertised house and unit supply. Shortages in advertised listings throughout COVID has helped fuel value growth by creating a sense of urgency among buyers.

Throughout January, the total advertised unit supply in Australia’s combined capital cities was down -3.7 per cent, compared to the same time last year, and 7.8 per cent below the previous five-year average. Over the same period, capital city house listings were down -12.5 per cent compared to this time last year and -32.7 per cent below the five-year average.

Whilst units did not experience the same growth that houses experienced over the past 12 months as a whole, growth conditions are becoming more diverse amongst the individual capitals and rest of state regions. Canberra, Darwin, Regional Victoria, and Regional Tasmina all recorded stronger unit growth over the three months to January, with the growth of 5.6 per cent, 2.6 per cent, 5.7 per cent and 9.2 per cent respectively, when compared to their housing markets.

It is likely affordability constraints will begin to pull more people away from houses and as a result, more demand will gather for affordable units. The reopening of international borders this month will further boost demand for units in Australia, and whilst many migrants initially rent in either Sydney or Melbourne, this could bolster rental demand in those markets hit hardest by the pandemic, resulting in a further boost to investor demand and more importantly unit prices.

CoreLogic’s Head of Australian Research, Eliza Owen joined Wealthi Co-Founder, Domenic Nesci on the Wealthi podcast last week addressing the aforementioned and many other interesting topics. If you would like to listen to the podcast, please click here.

If you would like to discuss the Australian property market in more detail, please reach out to the team to organise a time to have a conversation about how Wealthi can help you build a successful property portfolio.

Suggested articles:

Chris Hynes is Wealthi’s Global Research Analyst, Based in London