Rental property shortage on the horizon?

First there was the runaway house prices that soared to new levels despite the pandemic.

Now there are signs that rent could be rising too as Australia faces a potential shortage of rental properties.

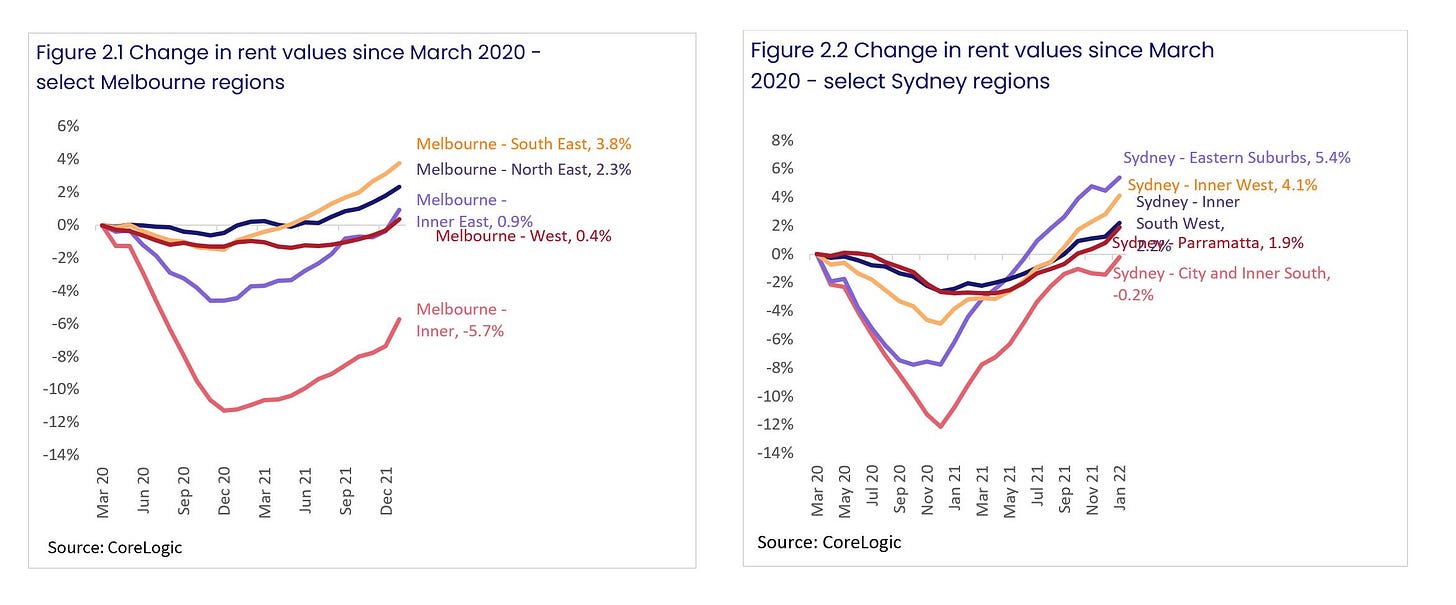

In a recent analysis of how Covid-19 has shaped the Australian property and housing market, CoreLogic said it Rent Value Index, which tracks changes in rental valuations over time, has surged to new record highs.

Eliza Owen, Head of Australian Research at CoreLogic said, “While rents saw a mild decline of -0.8% between March and August 2020, there was a swift recovery in these values, followed by a surge through 2021.”

At the same time, the increase in rent prices is being exacerbated by falling rental vacancy rates or the lack of available rental properties.

The fact is that as of late last year, property market analysts and observers have been warning about a tight vacancy rate. Some have called it a ‘landlord’s market’ as rental rates increased across the country.

Some industry figures showed that the number of vacant properties nationally has dropped from 54,000 dwellings in December 2020 to 37,000 in December 2021. This is a massive fall and contributed to even tighter rental vacancy rate.

Rent to rise further this year

Michelle Ciesielski, Head of Residential Research at Knight Frank said she expects rental property market to be even tighter later this year.

“With our international borders open now and as more people return to Australia, rental availability will be under more pressure. As we see population growth return to pre-pandemic levels, demand for housing and accommodation will rise. And rent will rise further.”

In a separate report, CoreLogic said, “Over the course of 2021, annual rent value growth was at its highest levels since 2008. Across Australia, median advertised rents since March 2020 have increased $30 per week to $470 per week.”

Lack of new apartment builds point to impending shortage

Industry reports released in the last quarter of 2021 showed that the fall in new apartment builds in Australian eastern seaboard could potentially translate to an under supply of much needed accommodation.

Domenic Nesci, co-founder at Wealthi, said, “Population has always been a key driver of demand for accommodation. And now that we’re seeing the return of overseas migrants – students, visitors and long-term residents, we expect the demand for apartments, townhouses and other medium-density accommodation.”

“If we don’t see a substantial level of new apartment builds, we could be facing a serious shortage in accommodation.” Nesci added.

Here’s a snapshot of rental vacancy rates across Australia:

National 1.7%

Adelaide 0.4%

Brisbane 1.3%

Canberra 1%

Darwin 1.3%

Hobart 0.3%

Melbourne 2%

Perth 0.6%

Sydney 2.6%

What does this tight rental market mean for property investors?

Despite the impending prospect of interest rate rise this year, we believe that property investors are in a better position than other mortgage owners who committed to massive loans to fund their homes.

Property investors can benefit from ongoing rent income that can buffer any rate rises.

And with rental rates expected to increase throughout the year, property investors who are in the process of building their property portfolio, may get further boost.

If you would like to discuss the Australian property market in more detail, please reach out to the team to organise a time to have a conversation about how Wealthi can help you build a successful property portfolio.