Australian home loans hit record levels despite easing attempts

Australian home loan borrowers came flocking back in November last year, driving a rebound in the overall value of home loan commitments for housing.

Figures released by the Australian Bureau of Statistics (ABS) showed that the value of new home loans jumped by 6.3 per cent in November 2021, representing the biggest rise in 10 months, to a total of $31.4 billion, in the same month that credit costs began to rise and the Australian Prudential Regulation Authority lifted the serviceability buffer requirement for lenders.

ABS Head of Finance and Wealth, Katherine Keenan, said: “The value of new loan commitments for owner-occupier housing rebounded 7.6 per cent in November. The rise was the first since May 2021 and the largest since January 2021”.

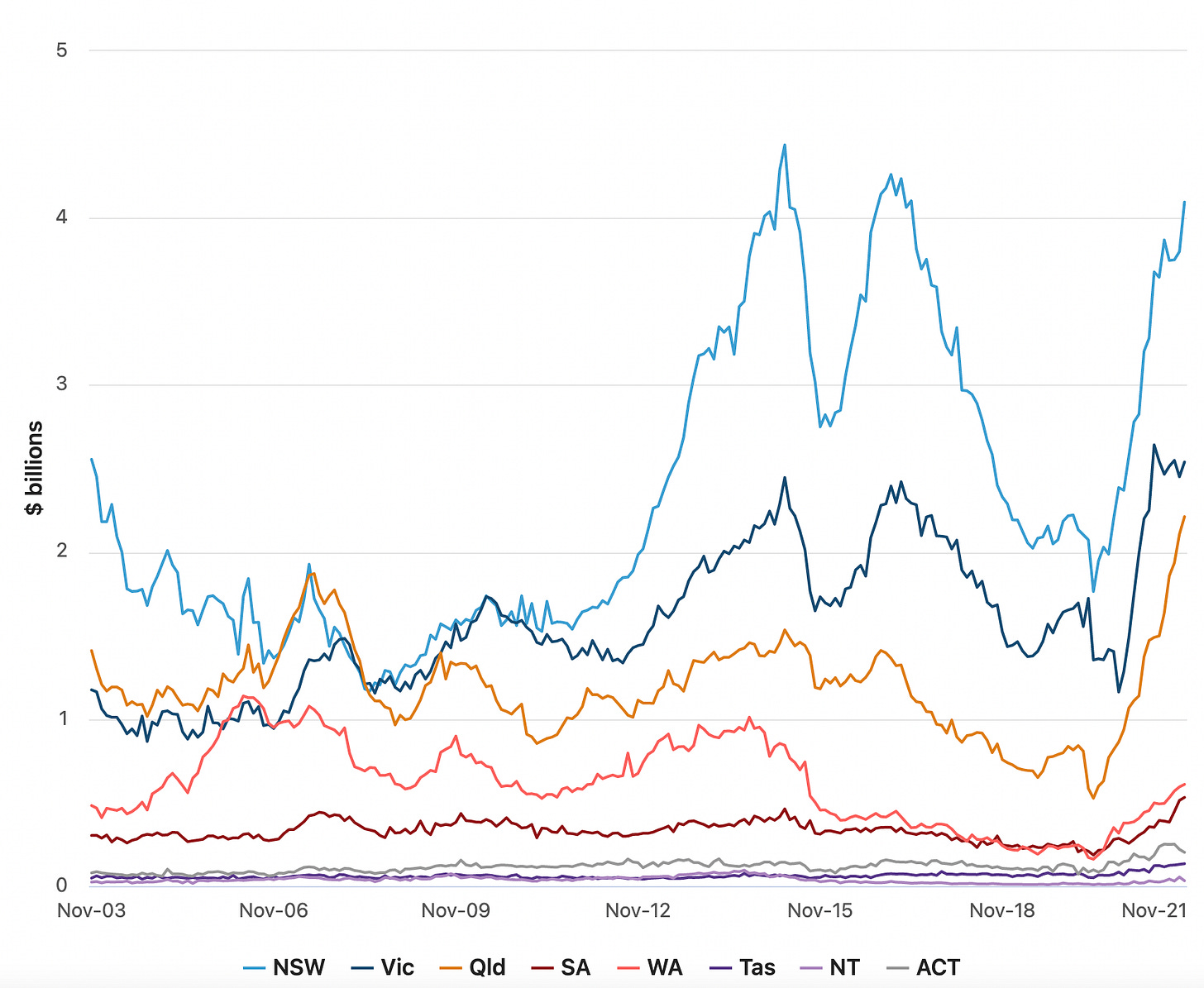

New South Wales and Victoria experienced the strongest increase in owner-occupier loan commitments rising 9.6 per cent, and 9.7 per cent respectively, corresponding with the easing of COVID restrictions in both states through October and November.

When analysing from a national level, the average loan size for owner-occupier dwellings rose to an all-time high of $596,000, rising 4.3 per cent. Average loan sizes reached new highs in all states and territories except Western Australia.

In terms of activity within the investor market, the value of new loan commitments to investors rose by 3.6 per cent, reaching a new all-time high of $10.1 billion. Ms Keenan said: “Investor lending has grown for the past 13 months, and accounted for around one-third of the value of new housing loan commitments in November 2021. The previous investor lending peak in April 2015 accounted for 46 per cent of new housing loan commitments.”

Over the year, the strongest investor loan commitments were in New South Wales, up 7.6 per cent, Queensland, up 5.0 per cent and Victoria, up 3.5 per cent. All Australian states saw a positive rise whilst both territories fell.

The number of new loan commitments to owner-occupier first home buyers rose 1.9 per cent in November 2021, breaking the decline since January 2021. In the same breath, the number of commitments was 17.4 per cent lower compared to a year ago.

Ms Keenan went on to say: “Victoria had the strongest rise of 12.3 per cent in the number of owner-occupier first home buyer loan commitments. The number of these commitments was 6.7 per cent lower than a year ago, after falling from record highs seen earlier in the year”.

Continuing on the theme of owner-occupier first home buyer loan commitments, New South Wales saw an increase of 2.2 per cent, and Western Australia saw a 1.3 per cent rise. Whilst, Queensland saw a dip of 1.5 per cent and South Australia fell 4.6 per cent.

What Does This All Mean?

The much-anticipated slowdown in Australia’s residential property market is yet to arise, in the first month after Delta lockdown restrictions were lifted, buyers resumed their search for new homes. As stated above, the value of home lending increased by 6.3 per cent in November, which represented the biggest uplift in 10 months, supported by record-low borrowing costs.

Demand for Australian real estate remains firm, but affordability has decreased due to home prices surging more than wages. As the average property price rose to an all-time high of $595,000, it could present the issue around squeezing first home buyers out of the housing market.

On reflection, disruption caused by the ongoing Omicron virus infections, affordability constraints, slower population growth, rising fixed mortgage rates and new regulatory measures to tighten serviceability requirements for a new mortgage, are all likely to slow home price growth in 2022, yet it is expected we will continue to see positive growth throughout the year.

If you would like to discuss the Australian property market in more detail, please reach out to the team to organise a time to have a conversation about how Wealthi can help you build a successful property portfolio.

Chris Hynes is Wealthi’s Global Research Analyst, Based in London