What's in Store For The UK Housing Market in 2022?

The UK property market continued to go from strength to strength through 2021, according to the latest Halifax House Price Index report released on 7th January 2022. As we start the new year, we can reflect on numbers from December 2021, providing the opportunity to gain an insight into how 2022 will shape up for the UK market.

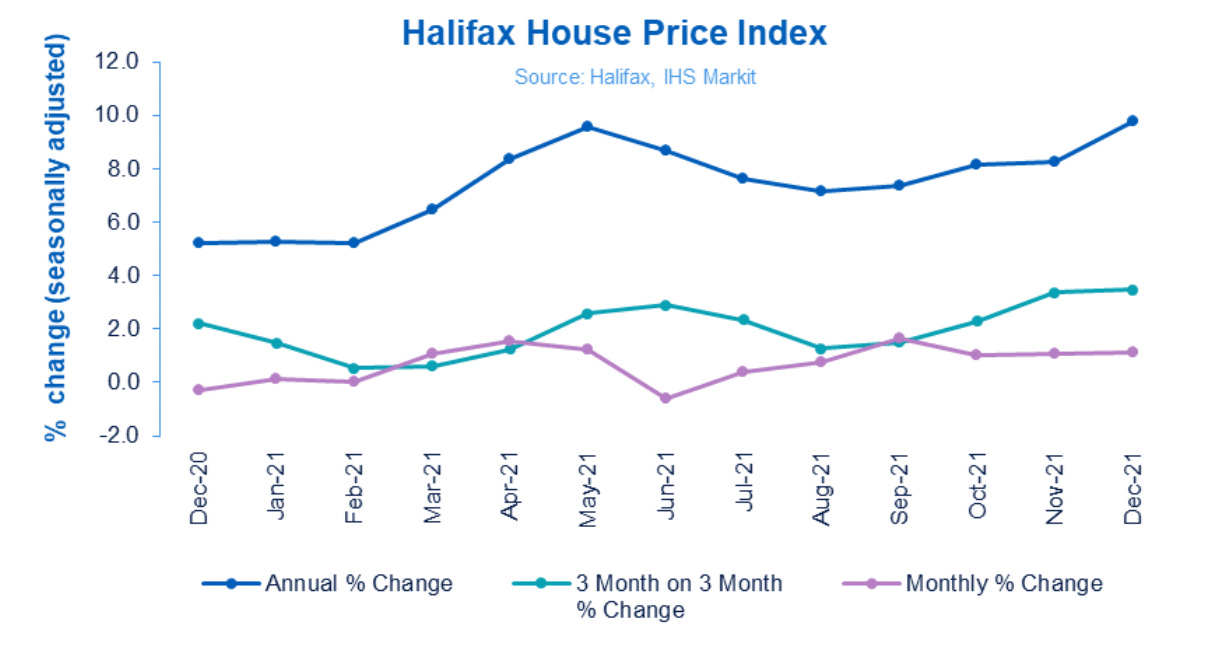

As a whole, house prices in the UK were up 9.8% in 2021, taking the average property price up to a record high of £276,091. House prices have increased by over £24,500 in 2021, the largest annual cash rise since 2003. With this in mind, according to the Halifax report, house price growth is expected to slow in 2022, as we have seen the end of the stamp duty holiday, along with other government-based schemes such as furlough, whilst the prospect of increased mortgage rates looms over with the hope of tackling rising inflation.

Russell Galley, Managing Director of Halifax, said: “The housing market defied expectations in 2021, with quarterly growth reaching 3.5% in December, a level not seen since November 2006. In 2021 we saw the average house price reach new record highs on eight occasions, despite the UK being subject to a ‘lockdown’ for much of the first six months of the year.”

As a result of the restrictions that were put in place, there was a lack of spending opportunities available, which helped boost household cash reserves. A combination of the aforementioned, as well as the stamp duty holiday, and the race for space as a result of working from home, encouraged many buyers to accelerate their plans to purchase a home. Furthermore, as a result of the government’s job and income support schemes, such as furlough, further confidence may have been provided to proceed with purchases.

On top of the above, due to the lack of available homes for sale, and the historically low mortgage rates, have both helped further drive annual house price inflation to 9.8% which is the highest level of growth seen since 2007.

Mr Galley adds, “Looking ahead, the prospect that interest rates may rise further this year to tackle rising inflation and increasing pressures on household budgets suggest house price growth will slow considerably”. Halifax expects that house prices will maintain their current strong levels, but that growth relative to the last two years will be at a slower pace. However, there are many variables that could push house prices either way, depending on how the pandemic continues to impact the economic environment.

Upon reflection, the UK property market experienced an extremely strong end to 2021, with much of that momentum carrying over into 2022. As stated above, it is predicted that we will continue to see steady growth through 2022, however, not at the same levels experienced over the past 2 years as we continue to watch the pandemic play out.

If you would like to discuss the UK Property Market, click below to book in a time with our team.