Change is in the air

It’s great to be back in the office this week, contemplating and planning about the big themes that will make a difference this year. I spent a lot of time over the holiday thinking about inflation and the general cost of everyday items. With kids on school holidays and travelling, you can’t help but wonder what the world is coming to with prices rising so quickly!

It’s easy to get emotional over inflation and higher costs but it’s equally important to see this as a trend that, like all other things with life, moves up and down. We enjoyed low inflation for the past 20 years, mainly thanks to China becoming the world’s factory and producing goods at rock bottom prices. A lot of that changed during the pandemic, but we’re slowing going back to life as normal.

The big news over the holidays was that China is opening back up, that will have a huge impact (positive) to the global economy. I wrote about that last week, click here to read.

Inflation was the big theme in 2022 but I think there is some change in the air. We saw evidence of that last week with US inflation coming in much lower than the past few months. That sent the price of everything higher — stocks, gold, bitcoin. Investors are looking at December’s number as evidence that perhaps prices have stopped rising and eventually interest rates will stop rising too.

Australia, Canada and Europe generally lag the US economy by a few months. If the trend in the US remains (and markets are suggesting that it will), we could start to see inflation coming back in these countries also by say March/April. That means central banks will be mindful of their interest rate decisions.

So here is how we think it will play out.

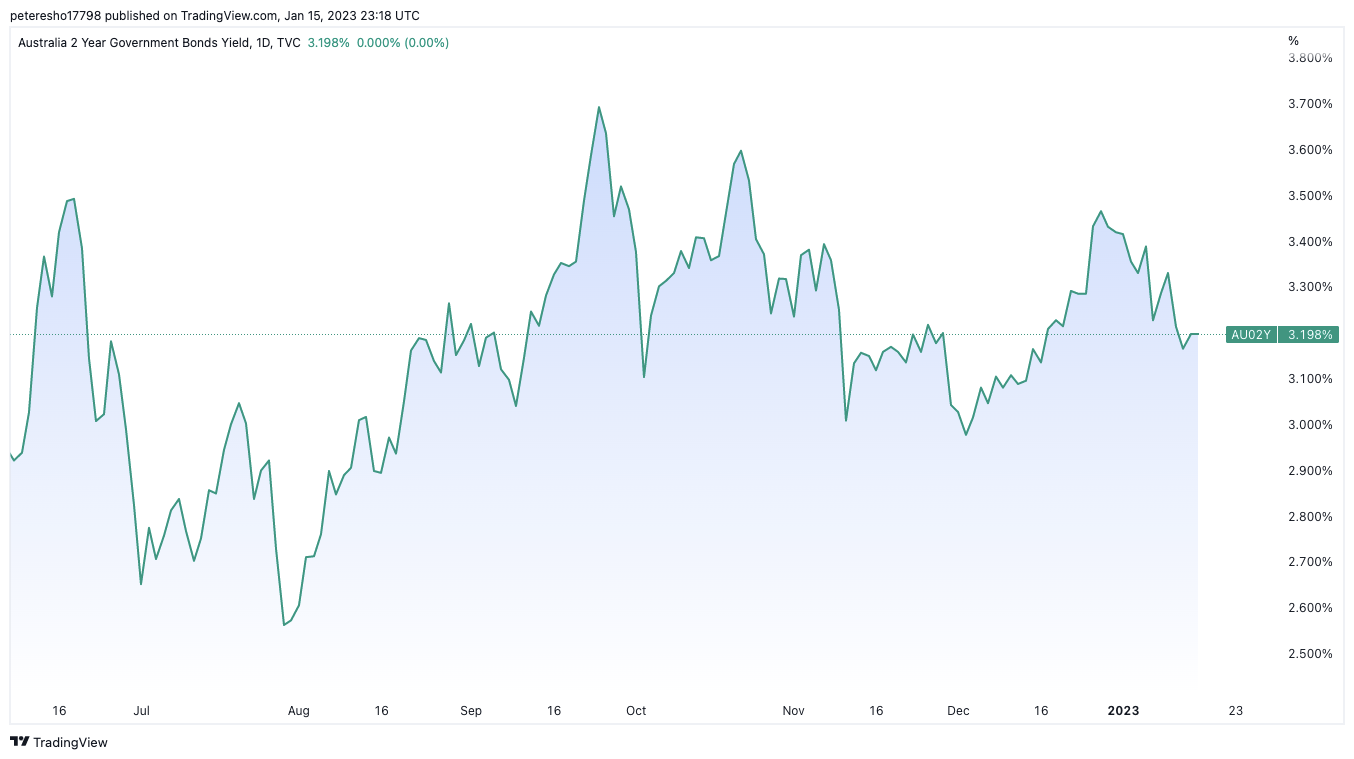

I think we’ll see the RBA here in Australia move one more time by 25 basis points and then wait to see what the data suggests. We’ll probably start to see inflation moderating, much like America, especially as recent interest rate rises start to bite and with energy prices having fallen from their previous highs. The RBA will pause for at least 6 months until get its evidence that inflation is under control.

Then we will get a change to wording and we could potentially start to see talk of interest rate cuts towards the end of next year.

Now I don’t have a crystal ball and this is one hypothesis which may or may not happen. But experience has taught me to always look through the valley and remain focused on the future, not the past, especially when it comes to investing. What happens in the US market and with inflation in particular will have a profound impact on interest rate movements in all other markets.

The residential real estate market will move with interest rate expectations. It’s not today’s rates that matter, that’s already priced in. It’s about interest rate expectations of the future. Once the market gets a hint that rates could have potentially peaked and likely to fall (in the next six months), the market will start to bottom and show signs of growth again.

The newspapers and 6 o’clock news headlines in December were all about how much property prices have fallen. What they don’t tell you is that they have fallen 10% after rising by 40% in the space of a couple of years. They also don’t tell you just how much more expensive it is to build a house compared to a few years ago.

That’s why I believe the best time to buy straw hats is in winter and the best time to buy real estate is when the market has softened, not when the market is hottest. Make sure you subscribe to get all our updates as we publish them to our thousands of subscribers every week.

Peter Esho is an economist and Co-Founder at Wealthi. He has 20 years of experience in investments and markets, publishing writing his weekly thoughts at peteresho.com